Cost Structure in Business Model Canvas: The Cornerstone for Building a Profitable Business Model

Published: 19 July, 2023

Business Models

Table of Contents

Businesses often struggle with managing their finances. With a great idea and a great product or service, it’s easy to just assume all the bills will get paid and everything will turn out all right. People who start businesses are energized by the value they’re delivering but are measurably less enthusiastic when it comes to actually running the business.

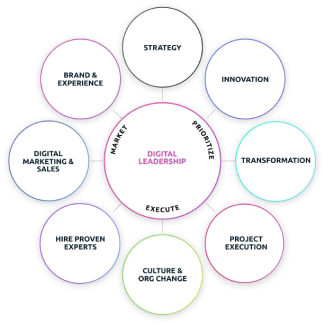

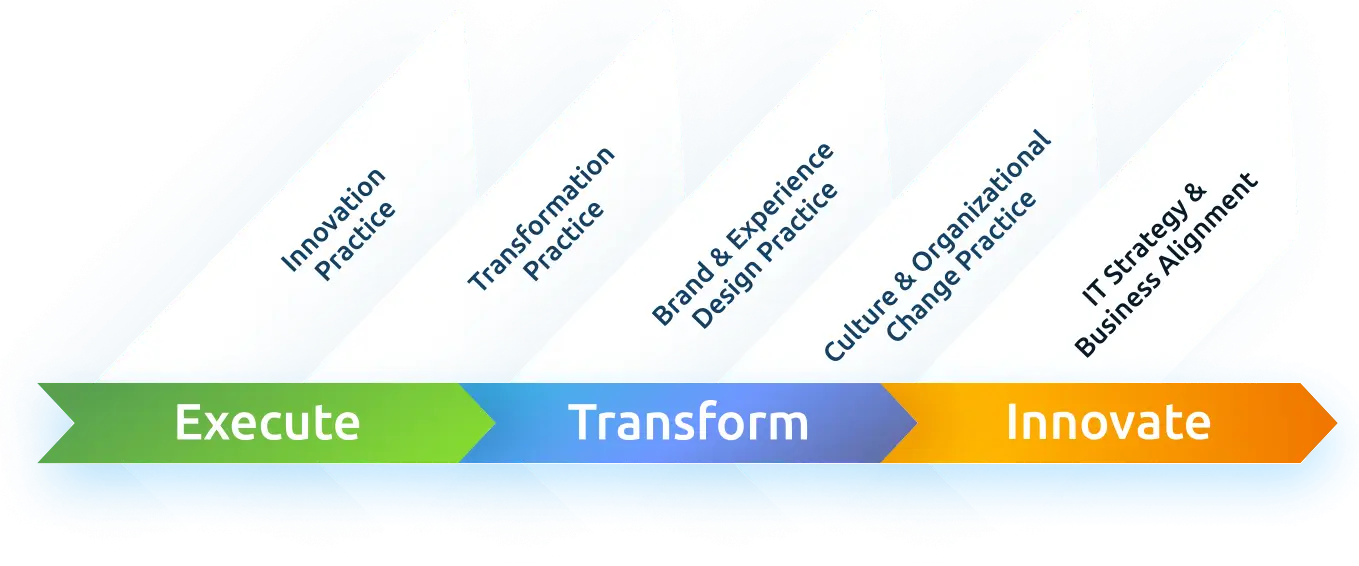

Understanding how a business’s Cost Structure influences the entirety of the operation is essential for ensuring the company’s success. Seeing it at work within a larger Business Model Canvas helps put your Cost Structure into the proper context. At Digital Leadership, we provide Business Model Strategy services to help businesses update and adapt their business models, companies can expand their customer segments through online reach, offer innovative products and services to meet evolving customer needs, improve customer experiences through personalization, streamline processes, and enhance customer service.

In this article, we discuss the role of Cost Structure in your overall business model, and how adjusting it is an important site of innovation loaded with possibilities. We touch on some of the reasons why Cost Structure plays such a vital role in business innovation. We also discuss some ways to alter your Cost Structure to make innovation and transformation possible. The experts at Digital Leadership have plenty more to say about all of this, so don’t hesitate to reach out through our website.

You can find comprehensive information about all the Building Blocks in the Business Model Canvas, just like always. About all Building Blocks in Business Model Canvas is available on the Digital Leadership website and in our book, How to Create Innovation.

Cost structure definition

Cost Structure refers to all the ways a business approaches paying its bills, such costs take many forms: the fixed cost of building rental, the variable cost of hourly wages, the sometimes-unpredictable costs of repairs or disaster response.

How a business prepares for fixed and variable costs, overhead expenses, production supplies, and any number of other concerns must be completely reflected in its cost structure.

Cost Structure is the aggregate of all the ways a business must spend money. Companies can use Cost Structure within an overall Business Model to identify where expenses can be reduced.

Cost Structure in Business Model Canvas

Cost structures play a key role in the Cost Model of your Business Model Canvas. The cost structure concept helps guide how you target innovation and value proposition development. Through understanding cost structures, you can aim to reduce costs, as well as make the most from every cost your business incurs.

Business Model Canvas Building Blocks

Cost Structure is just one of the many building blocks of the Business Model Canvas. It’s useful in understanding the overall impact of Cost Structure to consider the remaining fields in the Canvas.

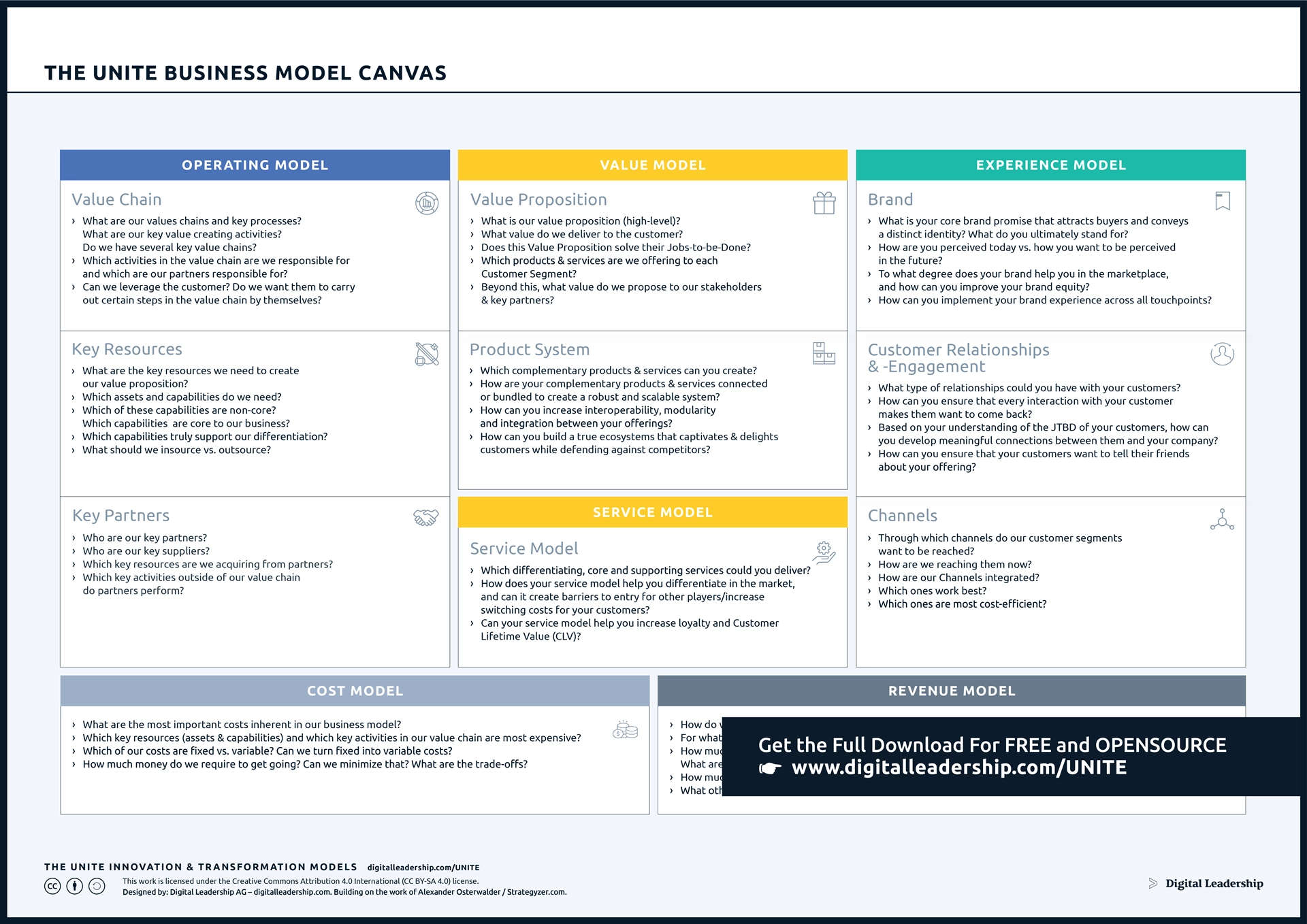

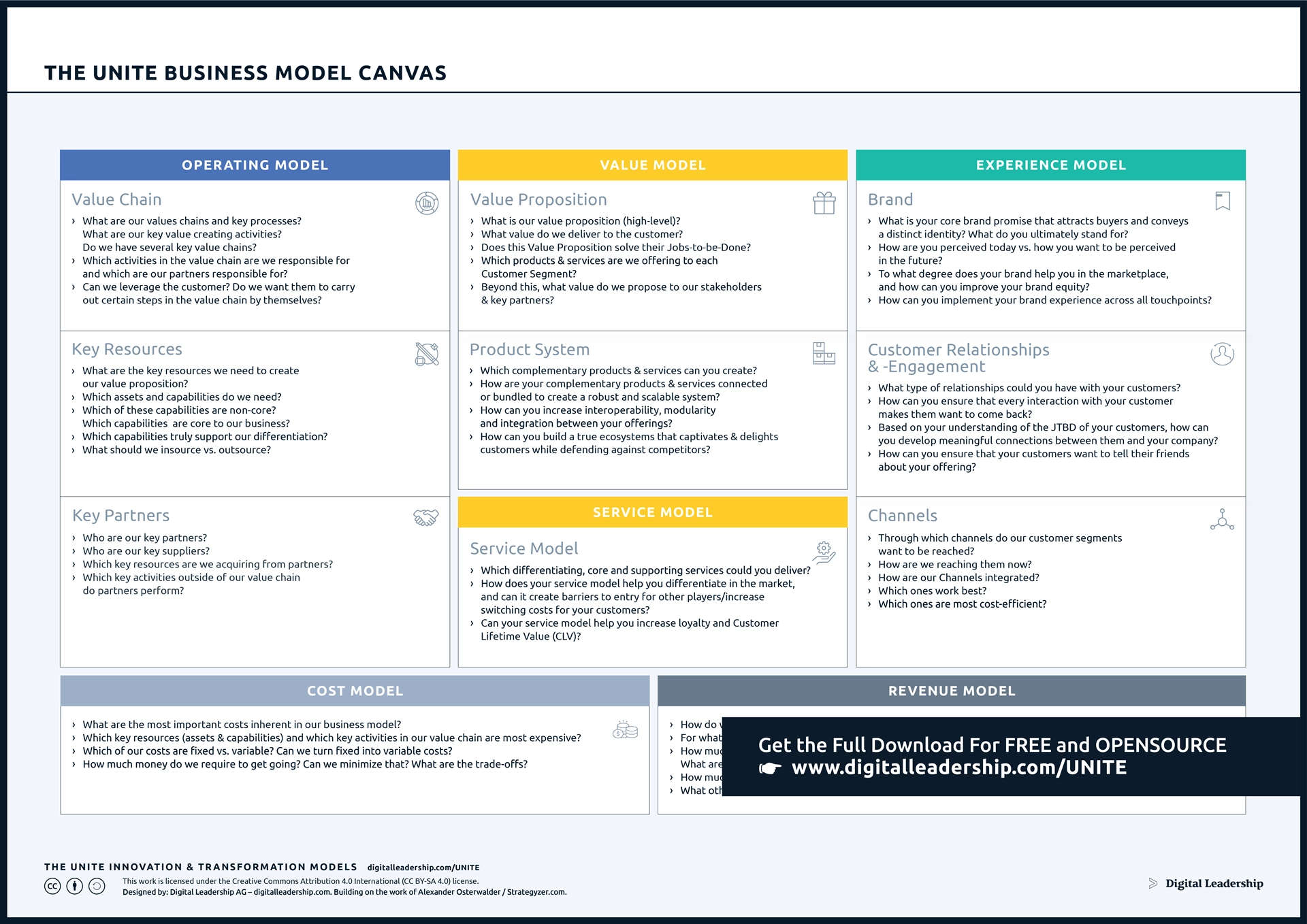

We’ve written about the Business Model Canvas Building Blocks before, so they are presented here only briefly. Unlock the full potential of your business and gain a deeper understanding of your cost structure with The UNITE Business Model Canvas. This powerful and innovative framework offers a comprehensive approach to visualizing and analyzing your cost-related aspects within the context of your entire business model. By using the UNITE Canvas, you can identify cost drivers, allocate resources efficiently, and uncover opportunities for cost optimization. You can download it now!

Designed by: Digital Leadership AG – Building on the work of Alexander Osterwalder

Related Article: Business Model Canvas 101: Everything You Need to Know to Succeed

(1) Key Resources

A list of your Key Resources, which can be categorized into physical, financial, intellectual property, and unique people skill sets. Their placement in the Business Model Canvas ensures that we give them full consideration from multiple angles.

(2) Key Activities

Your Key Activities should never be outsourced: they’re far too important. But other, tangential activities that are necessary though not at the core of your business (copy machine maintenance, for example) can be handled by contractors or other outside entities.

(3) Key Partners

Without your Key Partners, your Core Activities would be impossible. Relationships with your Key Partners, therefore, are vital to your success and should be nurtured and cared for appropriately.

(4) Distribution Channels

Rarely does a company deliver its goods or services to customers without some third-party distribution channels. Understanding the role Distribution Channels play in how we deliver value to our customers is important to understanding the overall Business Model.

(5) Customer Relationships

Different businesses have different relationships with their customers, but they should never be positioned in opposition to each other. The clearest way of ensuring proper attention is paid to Customer Relationships is through the Jobs to be Done framework, which is a major segment of the UNITE eXtended Business Model Canvas.

(6) Customer Segments

Personas help you understand who your customers are as people within their broad segments so you can better reach them and bring them value. Through them, you differentiate between different customer segments.

(7) Revenue Streams

Revenue Streams outline how you earn money. A Business Model can involve transactional revenues resulting from one-time customer payments (e.g., a sale) or recurring payments (e.g., a subscription).

(8) Value Proposition

It helps to project, test and build the business Value Proposition in a more structured and reflective way, just as the Business Model Canvas helps you do so during the process of designing a Business Model. Including the Value Proposition Canvas as an element of the more extensive Business Model Canvas helps give you full visibility into your plans. It’s more than worth the added effort.

Cost Structure Examples

The Cost Structure is a key component of the Business Model Canvas (BMC), a strategic management tool used to describe and analyze a business model. It outlines the major costs and expenses associated with operating a business. Here are some examples of cost structures that businesses may encounter:

- Fixed Costs: These are costs that remain relatively constant regardless of the level of production or sales.

- Rent or Lease Payments: The cost of renting office space or a manufacturing facility.

- Salaries and Benefits: Regular salaries paid to employees and associated benefits such as insurance and retirement contributions.

- Insurance: Business liability insurance, property insurance, etc.

- Depreciation: The allocation of the cost of assets over their useful life.

- Utilities: Regular expenses for electricity, water, gas, internet, etc.

- Variable Costs: These costs fluctuate based on the level of production or sales.

- Raw Materials: Costs associated with purchasing materials to produce goods.

- Manufacturing Costs: Expenses related to the production process, such as direct labour costs.

- Sales Commissions: Payments made to sales representatives based on the volume of sales.

- Shipping and Freight: Costs for delivering products to customers.

- Cost of Goods Sold (COGS): The direct costs of producing goods or services sold by a company.

- Operating Costs: These are ongoing expenses essential for running the day-to-day operations.

- Marketing and Advertising: Promotional costs to attract customers and increase brand visibility.

- Research and Development (R&D): Expenses related to developing new products or improving existing ones.

- IT Infrastructure: Costs associated with maintaining computer systems and software.

- Customer Support: Resources allocated to assist customers with inquiries or issues.

- Office Supplies: Expenses for basic supplies necessary for office operations.

- Customer Acquisition Costs (CAC): The cost incurred to acquire a new customer.

- Marketing Campaigns: Costs associated with advertising and promotional activities to attract new customers.

- Sales Team Expenses: Salaries, commissions, and other costs related to the sales team’s efforts to acquire customers.

- Free Trials or Discounts: Costs incurred from offering free trials or discounts to entice new customers.

- Distribution Costs: Costs associated with delivering products or services to customers.

- Warehousing: Expenses related to storing and managing inventory.

- Distribution Channels: Costs associated with utilizing third-party distributors or sales channels.

- After-Sales Support: Costs associated with providing customer support after the sale.

- Warranty and Repairs: Costs related to honouring warranties and repairing or replacing defective products.

- Customer Service: Expenses for assisting customers with post-sale inquiries or issues.

Differentiating Cost Structure Types for Your Business

There’s a good chance you don’t know, at least not in a formal way. To be successful, Cost Structures need to be intentional. Unless you’ve made a selection and followed through, you’re probably experiencing unnecessary costs.

What are the different Cost Structures that might appear in your Business Model Canvas? Let’s look at some.

(1) Fixed Cost Structure

The most predictable kinds of costs are Fixed Costs, and a Fixed Cost structure is useful for many types of businesses.

Definition & Explanation

These are costs incurred no matter how many goods or services the business produces. These costs tend to be recurring, like rent, insurance, or loan payments. A fixed cost is usually predictable.

Fixed costs are often capital investments and other overhead costs.

Advantages and Disadvantages

Many of the advantages and disadvantages of a Fixed Cost Structure centre around the consistency and the constancy associated with this approach.

Some advantages of fixed costs in a business plan are:

- Budgeting predictability: Fixed costs provide a level of predictability in budgeting and financial planning, as they remain constant regardless of changes in sales or production levels.

- Planning stability: Fixed costs provide stability to a business plan and make it easier to plan for the future.

- Cost control: Fixed costs allow businesses to control costs better by ensuring that a set level of expenses is incurred each period, regardless of fluctuations in sales or production.

- Price setting: Fixed costs provide a basis for setting prices, as they are a known and constant expense that must be covered by sales.

- Investment justification: Fixed costs can be used to justify investment in long-term assets, as they provide a predictable ongoing expense for the life of the asset.

Some disadvantages of fixed costs in a business plan are:

- Inflexibility: Fixed costs are set and cannot be easily adjusted, making it difficult to respond to changes in market conditions or demand.

- Predictability: Fixed costs can be difficult to predict, making it challenging for businesses to accurately forecast their expenses.

- High burden: Fixed costs can place a high financial burden on a business, especially if sales are slow or there is a downturn in the market.

- Limited resources: Fixed costs can tie up a significant portion of a company’s resources, leaving less available for investment in growth opportunities.

- Cash flow challenges: Fixed costs can strain a company’s cash flow, making it difficult to meet regular expenses or make investments in the business.

(2) Variable Cost Structure

Not all costs are as predictable as Fixed Costs. When costs are subject to (sometimes large or quick) changes, these are Variable Costs, and like a Fixed Cost Structure, a Variable Cost Structure has its uses and challenges.

Definition & Explanation

A variable cost changes in relation to how many goods or services the business provides. While these costs can be predictable if the business is planning properly, they are not the same from one period to the next.

Variable costs include direct labour costs, direct materials costs, and maintenance payments.

Advantages and Disadvantages

Advantages of variable costs in a business plan’s cost structure include:

- Flexibility: Variable costs can change as production levels change, allowing businesses to adjust their costs to meet fluctuations in demand.

- Predictability: Variable costs are often directly tied to a specific unit of output, making it easier to predict the cost of production.

- Improved profitability: Since variable costs change as production levels change, businesses can increase their profitability by reducing their costs as production slows down or by increasing production to take advantage of favourable market conditions.

- Better cost control: By focusing on controlling variable costs, businesses can improve their overall cost structure and achieve better margins.

- Increased focus on efficiency: Because variable costs are directly tied to production, businesses are encouraged to focus on improving their processes and becoming more efficient to reduce their costs.

Disadvantages of variable costs in a business plan’s cost structure include:

- Volatility: Variable costs can be subject to fluctuations, which can make it difficult for businesses to plan and budget accurately.

- Lack of control: Variable costs are often outside of a business’s control, such as raw materials prices, which can lead to unexpected cost increases.

- Difficulty in planning: Because variable costs can change frequently, it can be challenging to accurately forecast expenses and plan for future production.

- Increased risk: Businesses with a high proportion of variable costs may be at a higher risk of financial instability, as their costs can change quickly and unpredictably.

- Reduced stability: Since variable costs change with production levels, businesses with a high proportion of variable costs may experience significant financial swings, which can reduce stability and make it difficult to maintain a consistent cash flow.

(3) Hybrid Cost Structure

Some businesses are in a position that lets them have a blend of Fixed and Variable costs.

In reality, most businesses have both types of costs in one way or another. But in a Hybrid Cost Structure, businesses are making an explicit choice to be sure to utilize both Fixed and Variable costs.

Definition & Explanation

A Hybrid Cost Structure refers to a business model that combines elements of both fixed and variable cost structures. In this model, some costs are fixed and do not change with changes in output or sales volume, while others are variable and increase or decrease with changes in output or sales volume.

With a Hybrid Cost Structure, businesses try to balance the benefits of stability and predictability offered by fixed costs with the flexibility and responsiveness offered by variable costs.

Advantages and Disadvantages

The advantages of a hybrid cost structure in a business plan cost structure include the:

- Improved predictability: By combining both fixed and variable costs, a hybrid cost structure allows businesses to have a more accurate understanding of their costs, which can improve their ability to forecast expenses and plan for future production.

- Better cost control: A hybrid cost structure gives businesses greater flexibility to control their costs, as they can adjust their variable costs based on changes in production levels while maintaining a stable base of fixed costs.

- Increased stability: By having a mix of fixed and variable costs, businesses can reduce the volatility in their cost structure and achieve a more stable financial position.

- Improved cash flow management: A hybrid cost structure allows businesses to better manage their cash flow, as they have a predictable base of fixed costs, which can help with budgeting and planning.

- Increased flexibility: A hybrid cost structure allows businesses to adjust their cost structure in response to changes in the market or changes in their production levels, which can increase their ability to respond to new opportunities or challenges.

Disadvantages of a hybrid cost structure in a business plan’s cost structure include:

- Complexity: A hybrid cost structure can be more complex to understand and manage than a purely fixed or variable cost structure, which can make it more difficult for businesses to plan and budget accurately.

- Increased difficulty in forecasting: Because a hybrid cost structure involves both fixed and variable costs, it can be challenging to accurately forecast expenses and plan for future production.

- Reduced focus on efficiency: A hybrid cost structure may result in businesses having a reduced focus on efficiency, as they have a mix of fixed and variable costs, which can lead to complacency in cost management.

- Increased overhead costs: A hybrid cost structure can result in increased overhead costs, as businesses may need to invest in additional resources to manage the complexity of their cost structure.

- Less straightforward cost structure: A hybrid cost structure may not be as straightforward as a fixed or variable cost structure, which can make it more difficult for stakeholders to understand the financial position of the business.

Factors to Consider When Choosing a Cost Structure

Like everything else in your enterprise, your Cost Structure will depend upon a combination of factors unique to your business. Let’s unpack some of the factors you should keep in mind when deciding upon your business’s Cost Structure.

(1) Business size and stage of development

Larger businesses typically have a more complex cost structure, with a larger proportion of fixed costs and a greater number of employees and operational expenses. On the other hand, smaller businesses tend to have a simpler cost structure, with a greater proportion of variable costs and lower overhead expenses.

Additionally, as your business grows and becomes more established, you may see a shift towards a higher proportion of fixed costs as you invest and expand.

Understanding how your business and its interests will change over time will help you recognize the need to change your Cost Structure.

(2) Industry type and competition

Different industries have different cost considerations based on factors such as the price of raw materials, the level of regulation, and the type of products or services offered. For example, a manufacturing company may have a higher proportion of variable costs to take into account the change in price of raw materials, while a service-based company may have a higher proportion of fixed costs as it projects employee compensation.

Competition can impact a company’s cost structure as businesses compete to offer the lowest prices or the highest quality products and services. You may need to make adjustments to how you do business based on others in your sector or changing beliefs in the marketplace.

(3) Product or service offered

If you are a business offering a product, then your cost structure will be influenced by the labour and raw materials that go into manufacturing. You may also experience shifts in costs to deliver your goods to consumers, a reality that was felt particularly acutely during the height of the global COVID-19 pandemic. Businesses that plan for shifts in these costs are much more robust than their competition.

If you are offering a service, while you may have some costs for materials, your main cost will be employee compensation. These are generally predictable, allowing you to plan for a somewhat stable future.

(4) Market demand and customer behaviour

Finally, the demand for your product or service will influence your costs. You’ll need to find the balance between economy of scale and not over-stocking supplies.

A business can use variable pricing strategies to align its costs with changes in customer demand. For example, a business may offer discounts or promotions to encourage higher sales during slow periods or increase prices during periods of high demand to maximize its revenue potential. You can plan for these, taking advantage of current trends and the availability of resources.

Conclusion

Cost Structure is an important component of your Business Model, so understandably, it features in the Business Model Canvas as well as other useful planning tools.

When considered properly, your Cost Structure is another aspect of your business ripe for innovation and development.

Frequently Asked Questions

1- Can a business change its Cost Structure over time?

Of course, a business can change its Cost Structure over time. As the business matures, or as the marketplace changes, Cost Structure should always be considered as an opportunity for innovation to leverage competitive advantages.

2- What are the 8 types of cost?

- Direct Costs: Expenses directly linked to producing a specific product or service.

- Indirect Costs: Overhead expenses supporting overall business operations.

- Fixed Costs: Constant expenses, unaffected by changes in production or sales.

- Variable Costs: Fluctuate based on changes in production or sales volume.

- Operating Costs: Day-to-day expenses necessary for running the business.

- Opportunity Costs: Potential benefits lost when choosing one alternative over another.

- Sunk Costs: Expenses already incurred and irrecoverable.

- Controllable Costs: Expenses that can be managed or influenced by specific individuals or departments.

3- What are some common mistakes businesses make when it comes to Cost Structure?

The first mistake many businesses make in regard to Cost Structure is not thinking about it at all. Cost Structure is an integral piece of your overall Business Model, which is why it’s included in tools like the Business Model Canvas.

The next common mistake businesses make is that they are often too entrenched in the status quo. Evaluating your Cost Structure should be a piece of your overall innovation plan.

4- Can a business have multiple Cost Structure types for different products or services?

Yes, some Cost Structures are more appropriate than others for different Business Models.

5- What are cost structures in marketing?

In marketing, the cost structure refers to the breakdown of expenses incurred in the process of promoting and selling products or services. Understanding the cost structure in marketing is essential for businesses to allocate resources efficiently and make informed decisions regarding their marketing strategies. Here are some key elements of the cost structure in marketing:

- Advertising and Promotion: Expenses for online and offline advertising, and promotional materials.

- Marketing Personnel: Salaries, bonuses, and training for marketing and sales teams.

- Market Research and Analysis: Costs for gathering consumer insights and market research.

- Digital Marketing Tools: Expenses for using digital marketing platforms and software.

- Content Creation: Costs for producing marketing content like blogs, videos, and infographics.

- Events and Trade Shows: Budget for participating in trade shows and events.

- Distribution and Sales: Expenses related to product distribution and sales efforts.

- Public Relations: Costs for PR agencies or in-house PR activities.

- Influencer Marketing: Expenses for collaborating with influencers.

- Social Responsibility: Costs for cause-related marketing efforts.

- Testing and Experimentation: Budget for trying new marketing strategies.

- Affiliate Marketing: Costs associated with affiliate commission payments.

Book How to Create Innovation

Book How to Create Innovation